All Categories

Featured

Table of Contents

Adolescent insurance policy may be offered with a payor advantage rider, which offers forgoing future costs on the youngster's policy in the event of the death of the individual that pays the costs. which of the following is characteristic of term life insurance?. Senior life insurance policy, in some cases referred to as rated death advantage plans, supplies qualified older applicants with very little entire life coverage without a medical exam

The maximum concern quantity of protection is $25,000. These policies are normally a lot more expensive than a totally underwritten policy if the individual qualifies as a common threat.

You choose to obtain one year of highly economical coverage so you can decide if you desire to devote to a longer-term policy.

The Federal Federal government established the Federal Personnel' Team Life Insurance Policy (FEGLI) Program on August 29, 1954. It is the biggest group life insurance policy program on the planet, covering over 4 million Federal workers and senior citizens, as well as several of their member of the family. Most workers are eligible for FEGLI protection.

Spouse Term Life Insurance

Because of this, it does not accumulate any money worth or paid-up value. It contains Standard life insurance protection and three choices. If you are a new Federal employee, you are automatically covered by Basic life insurance policy and your pay-roll office subtracts premiums from your income unless you waive the coverage.

You must have Basic insurance coverage in order to choose any of the options. The cost of Basic insurance coverage is shared in between you and the Federal government.

You pay the full cost of Optional insurance coverage, and the cost depends on your age. The Workplace of Federal Worker' Team Life Insurance Coverage (OFEGLI), which is a private entity that has a contract with the Federal Federal government, processes and pays cases under the FEGLI Program.

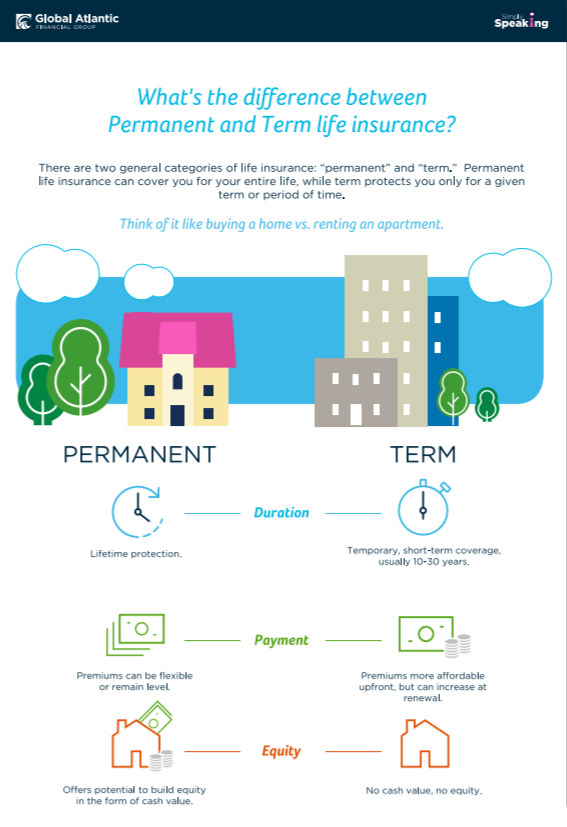

Term life insurance policy is a sort of life insurance policy that supplies protection for a details duration, or term, picked by the insurance policy holder. It's typically the most uncomplicated and affordable life insurance policy alternative by covering you for an established "term" (life insurance policy terms are typically 10 to three decades). If you die throughout the term duration, your recipients receive a cash money repayment, called a fatality benefit.

Term life insurance policy is an uncomplicated and economical service for people seeking affordable protection throughout details periods of their lives. It is essential for people to carefully consider their monetary goals and requires when picking the period and quantity of insurance coverage that ideal suits their conditions. That stated, there are a couple of factors that many individuals pick to get a term life policy.

This makes it an eye-catching alternative for individuals that desire substantial protection at a reduced expense, particularly during times of higher economic obligation. The other vital benefit is that premiums for term life insurance plans are dealt with for the period of the term. This implies that the insurance holder pays the exact same premium amount yearly, supplying predictability for budgeting objectives.

What Does Level Term Mean In Life Insurance

2 Cost of insurance coverage prices are identified making use of methodologies that differ by business. It's essential to look at all aspects when examining the total competition of rates and the worth of life insurance protection.

Like many team insurance plans, insurance policy plans provided by MetLife include certain exemptions, exceptions, waiting periods, decreases, restrictions and terms for maintaining them in pressure. Please contact your benefits manager or MetLife for expenses and complete details - what is a level term life insurance policy.

Our term life alternatives include 10, 15, 20, 25, 30, 35, and 40-year plans. The most popular kind is level term, meaning your payment (premium) and payment (death benefit) stays level, or the very same, till the end of the term duration. This is one of the most uncomplicated of life insurance policy options and requires extremely little upkeep for plan proprietors.

You can give 50% to your spouse and divided the remainder among your adult children, a moms and dad, a friend, or also a charity. * In some instances the survivor benefit may not be tax-free, discover when life insurance policy is taxed.

Term life insurance offers protection for a particular time period, or "term" of years. If the insured person passes away within the "term" of the plan and the policy is still effective (energetic), after that the survivor benefit is paid out to the recipient. which of the following is characteristic of term life insurance?. This sort of insurance policy commonly enables clients to at first buy more insurance coverage for much less cash (costs) than various other sort of life insurance policy

If anybody is depending on your earnings or if you have commitments (financial obligation, home loan, etc) that would fall to somebody else to manage if you were to die, after that the answer is, "Yes." Life insurance policy works as an alternative for earnings. Have you ever determined just how much you'll make in your life time? Typically, over the course of your working years, the response is generally "a lot of money." The potential danger of losing that gaining power profits you'll need to money your family members's most significant goals like acquiring a home, spending for your kids' education and learning, lowering debt, saving for retired life, etc.

Child Rider Term Life Insurance

Term life is the simplest type of life insurance. If you acquire term life insurance policy at a younger age, you can usually acquire even more at a reduced expense.

Term insurance coverage is preferably fit to cover particular needs that may decrease or go away in time Adhering to are two typical arrangements of term insurance policy plans you might wish to consider during the purchase of a term life insurance policy policy. permits the guaranteed to restore the plan without needing to confirm insurability.

Before they provide you a policy, the service provider requires to evaluate how much of a danger you are to insure. Certain hobbies like scuba diving are considered dangerous to your wellness, and that may elevate rates.

Is Voluntary Term Life Insurance Worth It

The expenses related to term life insurance policy premiums can differ based on these aspects - reducing term life insurance. You need to select a term length: Among the biggest concerns to ask yourself is, "How much time do I need protection for?" If you have kids, a preferred guideline is to select a term long sufficient to see them away from the house and with college

1Name your recipients: Who obtains the advantage when you pass away? You could choose to leave some or all of your benefits to a depend on, a philanthropic organization, or even a friend.

Consider Utilizing the penny formula: penny represents Financial debt, Revenue, Mortgage, and Education and learning. Complete your financial debts, home loan, and university costs, plus your wage for the variety of years your family members needs security (e.g., until the kids run out your home), which's your protection demand. Some financial specialists calculate the quantity you need making use of the Human Life Value philosophy, which is your life time earnings possible what you're making now, and what you expect to earn in the future.

One means to do that is to seek business with strong Financial toughness rankings. 8A business that underwrites its very own policies: Some business can offer policies from an additional insurance provider, and this can include an additional layer if you desire to change your policy or later on when your household needs a payout.

Some firms provide this on a year-to-year basis and while you can expect your rates to rise considerably, it may deserve it for your survivors. Another method to compare insurance coverage business is by considering on-line consumer reviews. While these aren't most likely to tell you a lot concerning a company's monetary security, it can inform you just how simple they are to deal with, and whether cases servicing is a trouble.

Life Insurance Short Term

When you're more youthful, term life insurance policy can be a straightforward means to shield your enjoyed ones. However as life modifications your monetary concerns can as well, so you may want to have entire life insurance for its lifetime insurance coverage and extra benefits that you can use while you're living. That's where a term conversion is available in.

Approval is ensured no matter of your wellness. The costs won't increase as soon as they're set, but they will go up with age, so it's a good idea to lock them in early. Find out more about exactly how a term conversion functions.

1Term life insurance policy supplies short-lived security for an essential period of time and is usually less costly than irreversible life insurance policy. 2Term conversion standards and constraints, such as timing, may use; for instance, there may be a ten-year conversion advantage for some items and a five-year conversion advantage for others.

3Rider Insured's Paid-Up Insurance coverage Purchase Choice in New York. 4Not readily available in every state. There is a cost to exercise this biker. Products and motorcyclists are offered in authorized territories and names and features may vary. 5Dividends are not assured. Not all taking part policy owners are qualified for rewards. For choose riders, the condition puts on the insured.

Latest Posts

Group Term Life Insurance Tax

Renewable Term Life Insurance Policy Can Be Renewed

Term Life Insurance Premium Increase